The Health and Wealth Connection

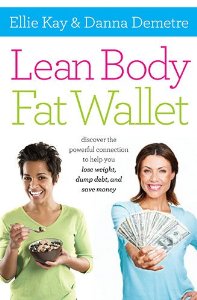

Ellie Kay’s new book, co-authored with Danna Demetre, offers wisdom principles from the Author of Life. In Lean Body, Fat Wallet, they help us upgrade two key areas of life: health and finances.

“It is as important to be fiscally fit as it is to be physically fit—but spiritual health trumps all else,” Ellie said.

Ah … I’m glad Ellie added that last phrase. When we are spiritually in tune with God, He gives us wisdom  for every area of life.

for every area of life.

Ellie continues …

One of the best ways to get our health and wealth in order is structure our lives according to Biblical principles. For example, Romans 13:8 says, “Let no debt remain outstanding, except the continuing debt to love one another.”

We are encouraged to love each other and to have no financial debt other to care for each other with a God-sized love. Furthermore, we can do a better job of caring for others if we are physically healthy enough to do the work and financially healthy enough to support the work.

The beginning of a Lean Body and Fat Wallet lies in getting rid of consumer debt.

Getting out of debt is like going on a diet—it may sound simple, but it sure isn’t easy.

The only thing that really works is to: spend less and save more.

Proverbs 22:7 says, “The rich rule over the poor, and the borrower is servant to the lender.” Debt doesn't benefit a marriage, a family or your future. Just as being overweight leads to health and emotional concerns, so debt has its consequences as well.

On the other hand, those who have a low debt load experience many benefits.

- There are fewer arguments over money their households.

- You can answer your phone and not worry about having to screen calls from creditors.

- You also have the freedom to financially bless others in need.

Stepping on the Scales: How to Know If You’re Financially Overweight

Maybe you’ve thought, “Hey, I’ve put a few dollars here and there.” There’s no more effective way to see if you have a problem, than as stepping on the scale.

You need to go on a debt diet if you:

- Use credit card cash advances to pay for living expenses.

- Use and depend on overtime to meet monthly expenses.

- Use credit to buy things that you used to pay for in cash (i.e. groceries, gasoline, clothing).

- Use the overdraft protection plan on your checking account to pay monthly bills.

- Use savings to pay bills.

- Use one credit card to pay another.

- "Float" the bills: you delay paying one bill in order to pay an overdue bill.

- Pay only the minimum amount due on charge accounts.

Consider making an appointment with the counselors at NFCC.org (National Foundation for Credit Counseling). You can also get out of debt sooner by reducing spending and repurposing those funds. As soon as you save in one area, immediately channel the money saved toward your debt load. If you don’t take that saved money and put it toward a credit card or other debt, then it will just get reabsorbed into your spending.

By following these biblical principles of good stewardship, you will find yourself with a Leaner Body and Fatter Wallet as well as the freedom that comes from living a healthy and wealthy life.

Do you need to go on a debt diet? Which of Ellie’s points do you think would help you the most?

Ellie Kay is a regular expert on national television with ABC NEWS NOW’s Money Matters and Good Money shows. She is also a national radio commentator, a

Ellie Kay is a regular expert on national television with ABC NEWS NOW’s Money Matters and Good Money shows. She is also a national radio commentator, a  frequent media guest on Fox News, and CNBC, a popular international speaker, and the best-selling author of fourteen books including her newest release, Lean Body, Fat Wallet (Thomas Nelson, 2013). For money savings links, or to view Ellie’s blog, go to www.elliekay.com.

frequent media guest on Fox News, and CNBC, a popular international speaker, and the best-selling author of fourteen books including her newest release, Lean Body, Fat Wallet (Thomas Nelson, 2013). For money savings links, or to view Ellie’s blog, go to www.elliekay.com.

Post a Comment → Posted on

Post a Comment → Posted on  Thursday, December 26, 2013 at 7:00AM

Thursday, December 26, 2013 at 7:00AM  Debt Diet,

Debt Diet,  Ellie Kay,

Ellie Kay,  Finances,

Finances,  Financial Debt,

Financial Debt,  Financial Freedom,

Financial Freedom,  Health and Wealth,

Health and Wealth,  Upgrade with Dawn Upgrade Your Life

Upgrade with Dawn Upgrade Your Life  Finances

Finances