How to 'Occupy' until Jesus Returns

In this New Year’s UPGRADE, I want to encourage us to keep on keeping on for the Kingdom of God. Hopefully, you will find some motivation to think through what is valuable to pursue in the coming year.

One of the words the Lord gave me when I recently found out I was out of remission with Multiple Myeloma was the word “OCCUPY.”

That word is in a parable Jesus told, found in Luke 19:11-26. The phrase is in verse 13 in the King James Version where it says, "occupy till I come."

The phrase is translated in different ways in other versions of the Bible:

- “Do business till I come” (NKVJ)

- “Put this money to work until I come back” (NIV)

- “Invest this for me while I am gone” (NLT)

- “Operate with this until I return” (MSG)

Obviously, Jesus used the concept of financial stewardship in this parable. But I want to expand that to something beyond finances as we think about the New Year.

But first, let me summarize the points in the parable:

1. Jesus had just finished talking to Zacchaeus, a tax collector—so the people were already thinking about money.

2. Jesus was on His way to Jerusalem for His last Passover before his crucifixion.

He told the parable because many people thought the kingdom of God was going to appear at that time.

3. In the parable—spoken to a large crowd—a man of noble birth went to a distant country to have himself appointed king.

4. Before he left, the master called 10 of his servants and loaned a mina to each of them. One mina was about the equivalent of three months’ wages.

The master told them to put that money to work until he returned. They were to “occupy” or do their business in a wise way.

5. The master—now a king—returned, and he sent for his servants to find out what they had “gained” with the money. One said he earned 10 more minas. Another said he earned five.

They were both diligent, trustworthy, and faithful.

And Jesus praised them both—rewarding them by giving them charge over 10 cities and five cities, respectively.

6. Then another servant came with his mina, hidden away in a cloth. Perhaps he was afraid of losing it. But he accused the master of “hardness."

So the king responded in hardness, calling him a “wicked servant.”

The man could have at least banked the money so it would collect interest. His mina was taken away and given to the good steward who had gained the ten minas.

7. Finally, the king responded to those who “hated him” after he left—those who rebelled against his authority. He had them executed (vv. 14, 27). (Remember that someday Jesus will defeat all His enemies.)

* Please see my note at the end about how this parable differs from the parable found in Matthew 25.

How to ‘Occupy’ Better in 2022

God used this parable to speak to me about making better "investments," and I don't mean just with money.

Many people choose a word for the new year, and I could have chosen any of the five words the Lord gave me regarding moving forward with my illness: Trust, Occupy, Discern, Rest, or Praise.

But I chose "Occupy" for my main word. Here is how the Lord is speaking to me about occupying, or UPGRADING my Stewardship, in the days to come. Maybe He will speak to you too.

(1) GODWARDNESS

"Godwardness" is my word for everything that upgrades my focus on my Father God, Jesus, and the Holy Spirit.

It involves everything from scripture reading and memorization to meditation, prayer, worship, singing to God and about Him—so many areas.

I asked myself recently, “Are you content with your adventure with God? Where could you make that journey more fulfilling—and better yet, more God-honoring?”

Then I asked the Lord about that and got better answers than I came up with initially!

Maybe those are questions you can ask as well . . . and then act for change.

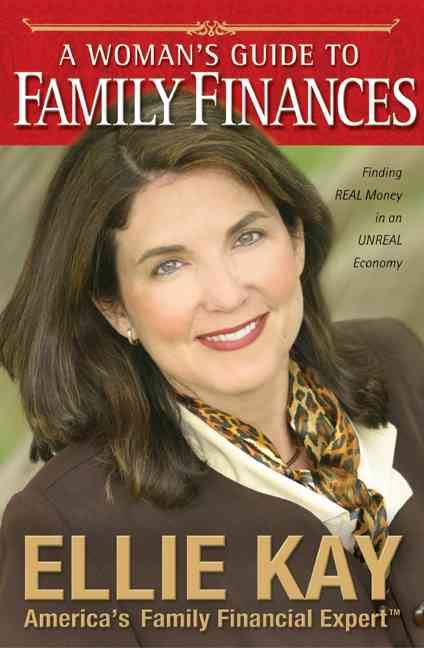

(2) FINANCES

Financial wisdom for investment is certainly one way to increase our stewardship. There are many ways to manage our finances biblically.

When I am more careful with my money, when I don’t buy unnecessary things, and when I curb my “wants,” I have more resources to support my church, send to missionaries, or share with others in their time of need.

Think about your finances as you enter this new year. Consider “investment” rather than spending, and see if your priorities change.

(2) TIME

I can also increase my stewardship of the use of my TIME.

For example, instead of plopping down to watch good television shows so much—which goes beyond eliminating programs that pollute the mind or spirit—I can use that time wisely, investing every opportunity for the Kingdom, especially in these evil days.

Certainly, I can read more of my Bible or helpful Christian books, but there are other activities I can do that are better investments of my time.

I’ll be honest here.

I’ve complained that I don’t have time to write that book I’ve wanted to write for so long. Given, I’ve been very ill. But if I can lie down to watch a movie, or spend an hour on Facebook on my phone, why can't I lie down and take notes for my book, or research for it online, etc.

Instead of “frittering away” free time (time beyond our responsibilities), how might we invest it wisely this year?

(3) RELATIONSHIPS

Our relationship with God is our primary relationship, but our human relationships are well worth investing in too.

Certainly our family relationships—those in our immediate home are a priority. But also, we can invest in other family members, friendships, co-workers, etc. (Ephesians 6:2; James 1:27a; Proverbs 17:17; 1 Thessalonians 5:11; Ephesians 6:5-9).

It’s easy, when our lives feel stressed, to turn inward; but if that continues for a while, it’s not healthy.

We need other people, especially our brothers and sisters in the body of Christ. And, in fact, the family of God was designed by God to help us in our times of stress.

So let's think about the relationships in our lives. How can we upgrade those relationships in positive, creative ways this year?

(4) OUTPUT

This area of stewardship is threefold:

- the investment of the SPIRITUAL GIFTS God has given us,

- development of new SKILLS, and

- better use of the TALENTS we've developed over time.

Our spiritual gifts were meant to be developed for God’s glory, not simply acknowledged.

Once we know our spiritual gifts—serving, encouraging, giving, leading, showing mercy, etc.—we should consider practical ways to use them under the guidance of the Holy Spirit.

Our skills and talents are things we have developed in our careers, as hobbies, or simply out of necessity. They are some of the things that make us unique in the family of God, and perhaps we need to be more creative in using them to build the body of Christ or minister to others.

For example, I have a friend, Kim, who founded a group called Kingdom Quilters in Southern California. The ladies make quilts and other things that they then take to orphanages and other sites of need in Guatemala and Mexico.

Is there something in your heart or hands that you could invest for the good of others and the glory of God?

(5) WITNESS

I also want to better invest in time to witness to others about God's gift of salvation in Jesus Christ. I don’t want to be disobedient to Christ’s command to share the gospel with people everywhere—whether as part of mission outreaches around the world—by going or giving so others can go—or by walking next door to share with my neighbor.

I know this is hard for some people. It’s never easy for me. But when I think in terms of obedience, or when I think about the Lord’s return, it’s more motivating, right?

What Are We Waiting For?

Just as the servants in the parable were rewarded with 10 cities and 5 cities, the Bible says God’s children will be rewarded with crowns. They will receive rewards according to their faithfulness and usefulness on earth.

We shouldn't want to be careless in any area of stewardship.

What are we waiting for?

The truth is, Jesus is coming back. We refer to His coming as “imminent”—it could happen any time (Matthew 24:36). Maybe in our lifetimes. Maybe in our children’s or grandchildren’s lifetimes.

But certainly, we need to be looking for His coming—anticipating it and living righteously in light of it (2 Timothy 4:8b). We need to be more aware of how we are using our time.

The Lord’s return is a great motivation to get busy serving Him (1 Corinthians 15:58).

The apostles understood that Jesus’ imminent return meant they should busy themselves with His work, because any day might be their last on earth.

The Bible doesn’t give Christians a “hold the fort” mentality—just waiting around until God calls us home. Instead, John said we should work while we can, because there’s coming a day when our working opportunities on earth will be over (John 9:4).

- I DON'T want to be indifferent, slothful, or careless.

- I DO want to be industrious, useful, creative, and God-honoring in everything I do!

I want to faithfully and creatively “occupy” until Jesus returns—or until He calls me home. I hope that's your desire too.

Which area of stewardship could use an upgrade in your life in 2022?

Dawn Wilson, founder and President of Heart Choices Today, is a speaker and author,  and the creator the blog, Upgrade with Dawn. She is a contracted researcher/reviewer for women's teacher and revivalist, Nancy DeMoss Wolgemuth at Revive Our Hearts, and is a regular columnist at Crosswalk.com. She and her husband Bob live in sunny Southern California, and Dawn has traveled with Him in Pacesetter Global Outreach. They have two grown, married sons, three granddaughters and a rascally maltipoo, Roscoe.

and the creator the blog, Upgrade with Dawn. She is a contracted researcher/reviewer for women's teacher and revivalist, Nancy DeMoss Wolgemuth at Revive Our Hearts, and is a regular columnist at Crosswalk.com. She and her husband Bob live in sunny Southern California, and Dawn has traveled with Him in Pacesetter Global Outreach. They have two grown, married sons, three granddaughters and a rascally maltipoo, Roscoe.

* (Note: The parable in Luke 19 is not the same parable found in Matthew 25:14-30, which was to His disciples on the Mount of Olives. The “talents” are different than the minas. The return of the master and the responses of the servants are different in the Matthew account.)

Graphic adapted, courtesy of Stux and TruthSeeker08, both at Pixabay.

Post a Comment → Posted on

Post a Comment → Posted on  Thursday, December 30, 2021 at 8:00PM

Thursday, December 30, 2021 at 8:00PM  Finances,

Finances,  Godwardness,

Godwardness,  Luke 19:11-26,

Luke 19:11-26,  Occupy till I come,

Occupy till I come,  Parables,

Parables,  Relationship building,

Relationship building,  Skills and Talents,

Skills and Talents,  Spiritual Gifts,

Spiritual Gifts,  Stewardship,

Stewardship,  Stewardship of Life,

Stewardship of Life,  Use of time,

Use of time,  Witnessing Upgrade Your Life

Witnessing Upgrade Your Life  New Year,

New Year,  Stewardship

Stewardship